The euro, pound, and Japanese yen have continued to trade within ranges.

Yesterday's statements by Trump about the potential firing of Federal Reserve Chair Jerome Powell became one of the day's most significant events. However, this did not affect the market dynamics. Despite the rhetoric against the Fed's independence, the markets appear to have grown accustomed to Trump's unconventional communication style. Traders may have concluded that firing the Fed Chair, while technically possible, is unlikely. Furthermore, the lack of significant economic data from the US left market participants without guidance or incentives to trade actively. Usually, the release of key macroeconomic indicators, such as employment, inflation, or GDP data, causes fluctuations in the currency market. However, during this period, attention was focused on political statements, while economic data took a back seat.

Today also promises to be fairly calm. There are no significant reports for the Eurozone and the UK in the first half of the day, which should not lead to serious market fluctuations. The wave of expectations and speculation typically surrounding key data releases has given way to silence, allowing markets to reassess recent events and outline a further course amid relative stability. This pause in macroeconomic news offers traders the opportunity to focus on New Year celebrations and the analysis of technical indicators.

If the data aligns with economists' expectations, it is better to act based on the Mean Reversion strategy. If the data are significantly above or below economists' expectations, the best approach would be to use the Momentum strategy.

Momentum Strategy (Breakout):

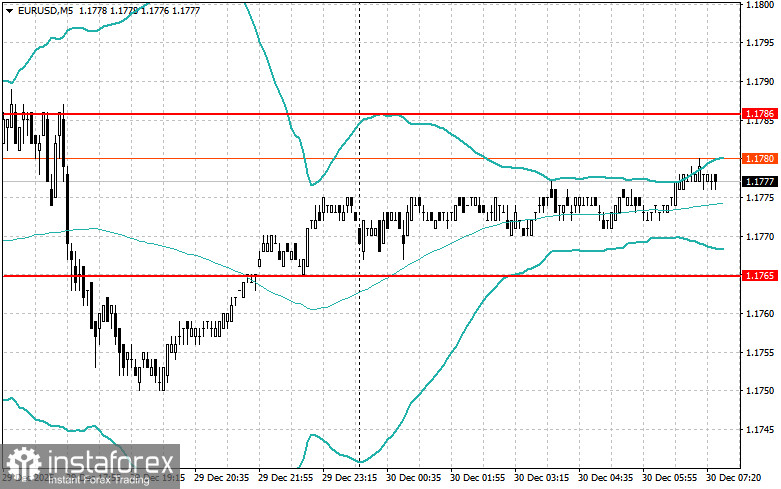

For the EUR/USD Pair

- Buy on a breakout of level 1.1785, which could lead to a rise in the euro to around 1.1807 and 1.1840.

- Sell on a breakout of level 1.1754, which could lead to a decline of the euro to around 1.1730 and 1.1706.

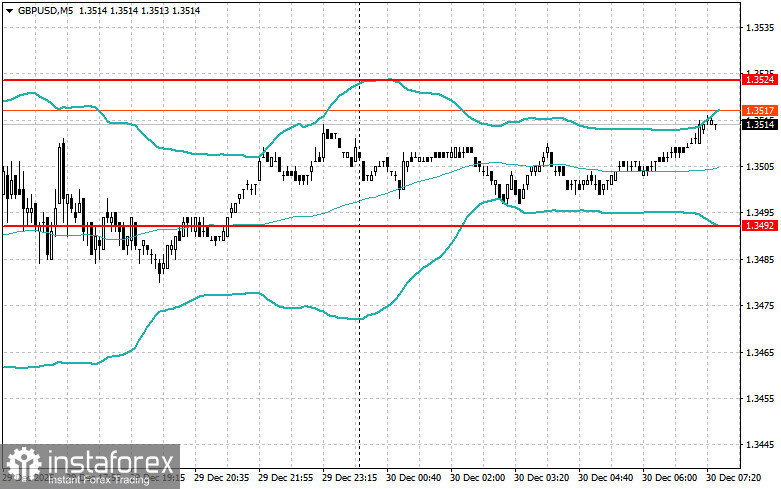

For the GBP/USD Pair

- Buy on a breakout of level 1.3531, which could lead to a rise in the pound to around 1.3561 and 1.3590.

- Sell on a breakout of level 1.3500, which could result in a decline of the pound to around 1.3470 and 1.3442.

For the USD/JPY Pair

- Buy on a breakout of level 156.30, which could lead to a rise of the dollar to around 156.68 and 157.05.

- Sell on a breakout of level 155.99, which could lead to the dollar falling to around 155.67 and 155.32.

Mean Reversion Strategy (Retracement):

For the EUR/USD Pair

- Look for short positions after a failed breakout above 1.1786, upon a return below this level.

- Look for long positions after a failed breakout below 1.1765 upon returning to this level.

For the GBP/USD Pair

- Look for shorts after a failed breakout above 1.3524, upon a return below this level.

- Look for longs after a failed breakout below 1.3492 upon returning to this level.

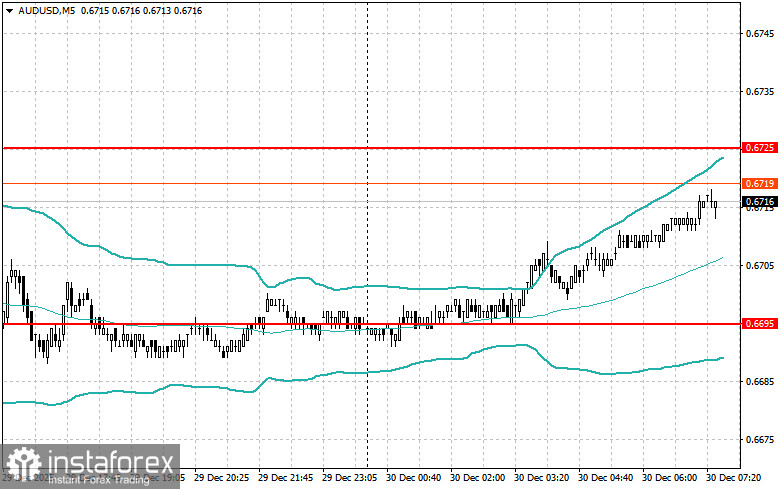

For the AUD/USD Pair

- Look for shorts after a failed breakout above 0.6725, upon a return below this level.

- Look for longs after a failed breakout below 0.6695 upon returning to this level.

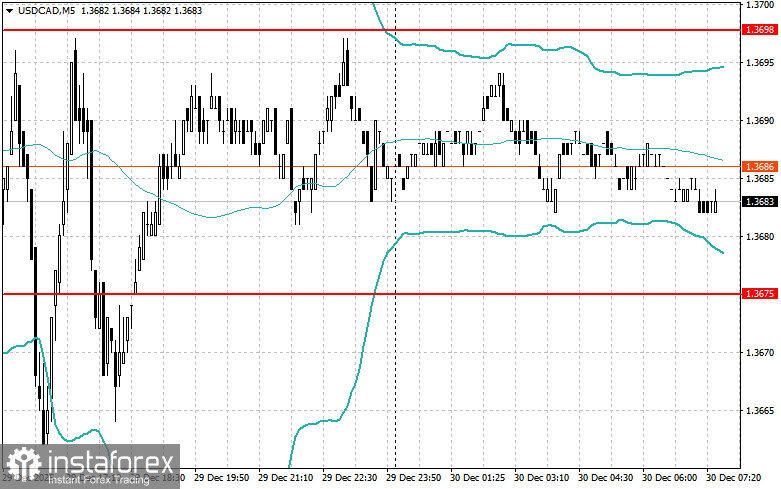

For the USD/CAD Pair

- Look for shorts after a failed breakout above 1.3698, upon a return below this level.

- Look for longs after a failed breakout below 1.3675 upon returning to this level.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română