Trade review and tips for trading the British pound

The test of the price at 1.3506 occurred when the MACD indicator was just beginning to move down from the zero mark, confirming the correct entry point for selling the pound. As a result, the pair fell by 30 pips.

Strong readings in the U.S. house price index and the Chicago PMI yesterday provided robust support to the U.S. dollar against the British pound. The published data reinforced investors' confidence in the resilience of the U.S. economy, despite ongoing debate about a possible slowdown in economic growth. The house price index, which showed unexpectedly strong growth, indicated persistent demand for real estate, an important gauge of overall economic health. The Chicago PMI, reflecting improved business activity in the region's manufacturing sector, confirmed that U.S. industry continues to adapt to changing conditions and shows signs of recovery.

Given the absence of key fundamental data for the UK today, the focus shifts entirely to technical analysis. This means market participants will closely monitor price action, chart patterns, and support and resistance levels to forecast the pound's next moves. In such conditions, short-term strategies and the ability to react quickly to shifts in market sentiment become particularly important. Traders using technical analysis will rely on indicators such as RSI, MACD, and the Stochastic Oscillator to identify potential entry and exit points. However, it should not be forgotten that even the best technical analysis cannot entirely eliminate the impact of unexpected news or geopolitical developments. At any moment, information may emerge that dramatically changes market dynamics and invalidates prior forecasts.

For the intraday strategy, I will primarily rely on implementing Scenarios #1 and #2.

Buy Scenarios

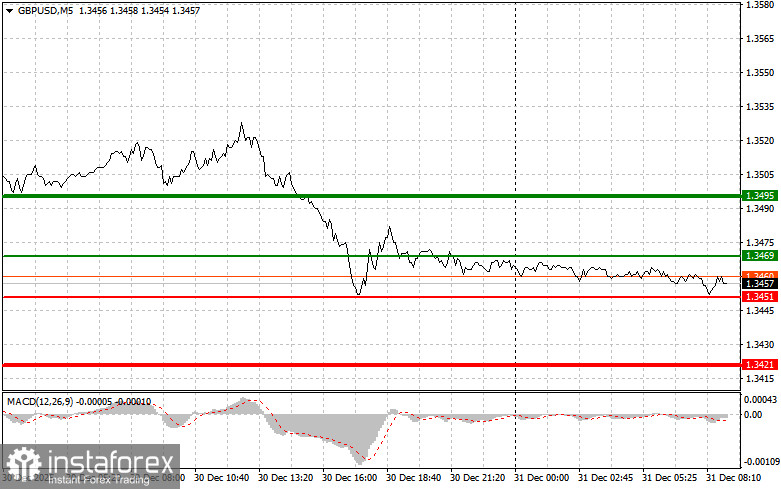

Scenario #1: I plan to buy the pound today at an entry point around 1.3469 (green line on the chart), targeting a rise to 1.3495 (thicker green line on the chart). Around 1.3495, I will exit long positions and open short positions in the opposite direction (aiming for a 30–35-pip move back from that level). A strong rise in the pound today is unlikely. Important! Before buying, ensure the MACD indicator is above zero and just beginning to rise.

Scenario #2: I also plan to buy the pound today if two consecutive tests of 1.3451 occur while the MACD indicator is in the oversold area. This will limit the pair's downside potential and trigger a reversal up. Expect a rise toward 1.3469 and 1.3495.

Sell Scenarios

Scenario #1: I plan to sell the pound today after the 1.3451 level is broken (red line on the chart), which should trigger a rapid decline in the pair. The sellers' key target will be 1.3421, where I will exit shorts and immediately open longs in the opposite direction (aiming for a 20–25-pip reversal from that level). Pound sellers may reappear as part of a correction. Important! Before selling, ensure the MACD indicator is below zero and is just beginning to fall from it.

Scenario #2: I also plan to sell the pound today if there are two consecutive tests of 1.3469 while the MACD indicator is in the overbought area. This will limit the pair's upside potential and cause a reversal down. Expect declines to 1.3451 and 1.3421.

What is on the chart:

- Thin green line – entry price at which you can buy the instrument;

- Thick green line – approximate price where you can set Take Profit or lock in profits, since further rise above this level is unlikely;

- Thin red line – entry price at which you can sell the instrument;

- Thick red line – approximate price where you can set Take Profit or lock in profits, since further decline below this level is unlikely;

- MACD indicator – when entering the market, it is important to be guided by overbought and oversold zones.

Important

Beginner forex traders must be very cautious when making entry decisions. It is best to stay out of the market before the release of important fundamental reports to avoid getting caught in sharp price swings. If you decide to trade during news releases, always place stop orders to minimize losses. Without stop orders, you can very quickly lose your entire deposit, especially if you do not use money management and trade large volumes.

Remember that for successful trading, you need a clear trading plan like the one presented above. Spontaneous trading decisions based on the current market situation are an inherently losing strategy for an intraday trader.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română