The escalation between Washington and the EU over Donald Trump's intention to incorporate Greenland into the United States is frightening financial markets and continues to boost demand for gold, which at present is the only safe-haven asset. Meanwhile, other assets that were recently considered safe havens are declining in value.

Thus, while the dynamics of gold are clear and fairly easy to understand, why is there a noticeable drop in demand for the dollar and cryptocurrencies?

In my view, the main reason is the likelihood that the Greenland crisis could prompt Europe to begin actively selling U.S. Treasury securities that were previously purchased as assistance to its suzerain, the United States. The U.S. debt market has already reacted to the possibility of such sales with sell-offs in Treasuries and, as a result, rising government bond yields. A potential demarche by the EU is having a negative impact on the attractiveness of dollar-denominated assets, which in turn is leading to a decline in the U.S. dollar on the Forex market.

At the time of writing, the ICE Dollar Index is down 0.03% and stands at 98.61 points. Major crypto assets are recovering after Tuesday's crash, but this rebound looks more like partial profit-taking than the start of a genuine market reversal from a downward trend to an upward one.

Today, all market attention is focused on Donald Trump's upcoming speech in Davos. If it was previously assumed that the main topic would be aid from Western countries, primarily Europe, to Ukraine, now it is, of course, the issue of the expected U.S. annexation of Greenland.

How Will Markets React to News from Davos?

I believe that Trump's persistence on the Greenland issue will only intensify geopolitical contradictions between the United States and the EU, pushing gold prices toward my target level of $5,000 per ounce. Naturally, against this backdrop, Europe's threat to begin selling Treasuries would lead to further weakening of the U.S. dollar on the Forex market and to declining demand in the cryptocurrency market.

Forecast of the Day:

EUR/USD

The pair is trading above the 1.1700 support level. Further escalation of the Greenland crisis may lead to a resumption of growth in the pair toward 1.1800–1.1810. A potential level for buying is 1.1705.

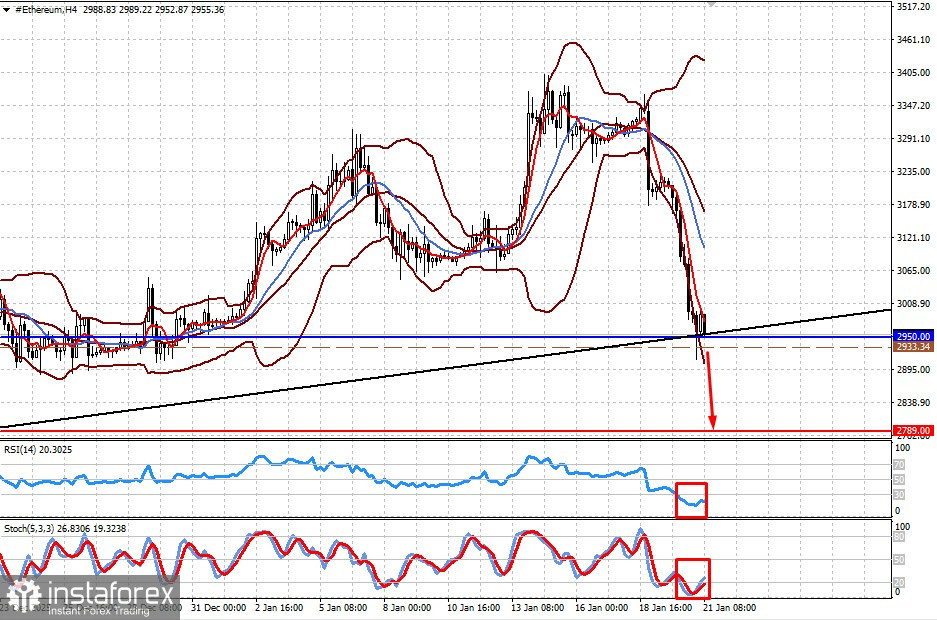

Ethereum

The cryptocurrency has fallen sharply in price since the beginning of this week amid developments surrounding Donald Trump's tariffs on Europe and the escalation of the Greenland crisis. After a local recovery, Ethereum may come under pressure again and fall toward 2,789.00. A potential level for selling is 2,933.34.

English

English

Русский

Русский Bahasa Indonesia

Bahasa Indonesia Bahasa Malay

Bahasa Malay ไทย

ไทย Español

Español Deutsch

Deutsch Български

Български Français

Français Tiếng Việt

Tiếng Việt 中文

中文 বাংলা

বাংলা हिन्दी

हिन्दी Čeština

Čeština Українська

Українська Română

Română